- Net Interest Margins (NIMs) peaking for US, Hong Kong, and Singapore banks; China banks continue to experience pressure from rates

- Competition for deposits fading from the peak in 1H23 as loan demand eases amid macroeconomic uncertainties

- While asset quality remains benign, there are pockets of stress across China and US commercial real estate exposure as NPL ratios tick up

- Broad-based concerns over high debt levels amongst Chinese property developers remain

- In US, downside risks to asset quality to be partially offset by proactive provisioning during the pandemic; Asian banks emerge as attractive dividend plays with undemanding valuations

Related insights

- Equinix Inc 26 Jul 2024

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Research Library26 Jul 2024

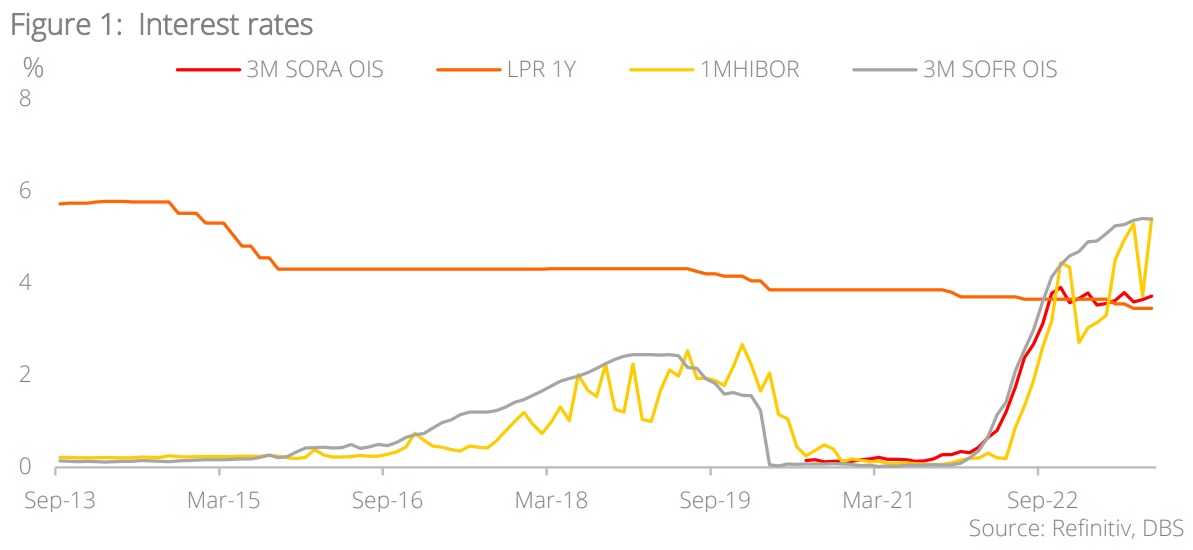

Competition for deposits started to fade slightly from the peak in 1H23 as loan demand eases amid macroeconomic uncertainties. Should deposit costs decline sharper than expected, NIMs could potentially peak further out into 1H24F. On the other hand, China banks are faced with further NIM pressure ahead, though less than what we saw in 1Q23. We expect further NIM decline for China banks in 2H23F, driven by 1) LPR cut in the earlier months of the year to impact newly issued loan yield; 2) On the deposit side, though RMB deposit rate is declining, foreign currency deposit rate remains high and time deposit migration trend continues; 3) LGFV restructuring and existing mortgage rate cut to have some impact in 2H23, but the majority of the negative effects will be felt in FY24F.

Asset quality remains benign; Keep an eye on commercial real estate exposure. While asset quality among global banks remains benign, there are pockets of stress across China and US commercial real estate (CRE) exposure as NPL ratios tick up. Higher vacancies continue to weigh on underlying valuations and the repayment of CRE loans, compelling banks to proactively write provisioning in anticipation of potential deterioration in asset quality.

In China, broad-based concerns over high debt levels amongst property developers remain. DBS believes that all state-owned enterprise developers should have sufficient free cash and presales to cover short-term bonds and operating expenses for the next 12 months without refinancing. China and Hong Kong banks remain cautious on China’s CRE.

In the US, new credit card and auto loan delinquencies have surpassed pre-Covid 19 levels since August 2023 as higher interest rates weigh on repayment abilities. Downside risks to asset quality include sharper than expected economic slowdown and persistently high inflation, which will in turn, be partially offset by proactive provisioning across banks during the pandemic.

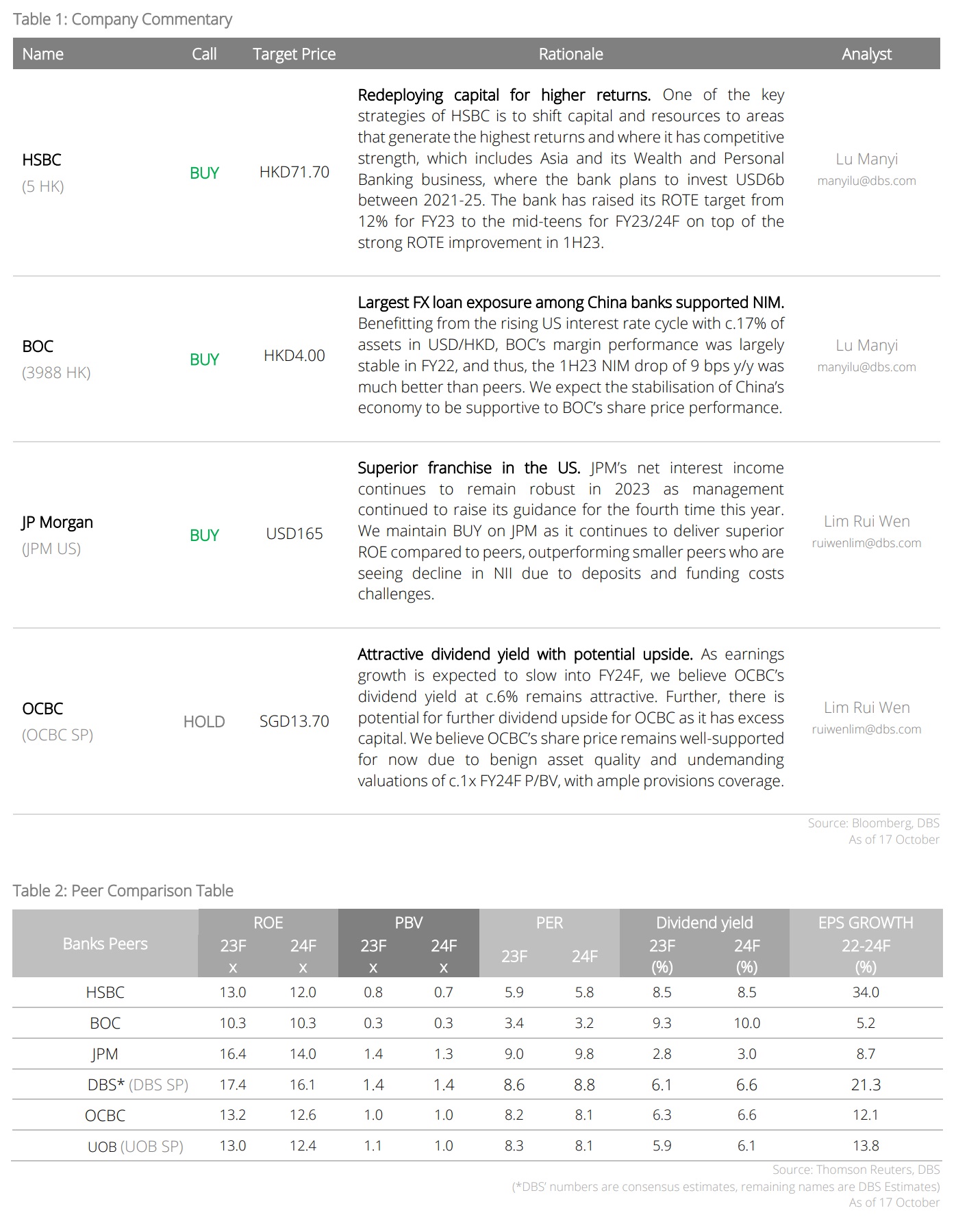

Asian Banks: Attractive dividend plays with undemanding valuations. China, Hong Kong, and Singapore banks are emerging as attractive dividend yield plays with forward dividend yields ranging 6-10%. Valuations are largely undemanding for China, Hong Kong, and Singapore banks. This is particularly so for China banks which are trading at c.0.3x forward P/BV. We believe that the risk-reward is favorable as prevailing valuations have sufficiently priced-in downside risks emanating from the economic and asset quality front.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Equinix Inc 26 Jul 2024

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Research Library26 Jul 2024

Related insights

- Equinix Inc 26 Jul 2024

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Research Library26 Jul 2024