- TOPIX deceleration influenced by rising US bond yields and concerns over a US credit rating downgrade, but P/E valuations leave room for further rerating, supporting a positive outlook for Japanese equities

- Poised for reflation, Ueda has dismissed possibility of an imminent exit from ultra-loose monetary policy, arguing that inflation driven by robust domestic demand and higher wage growth is necessary

- Stay with strategically important sectors with government support; Electronics, Automotive, Machinery, High-precision equipment, and Tourism

- Explore opportunities in Retail, F&B, and Japan banks

Related insights

- Equinix Inc 26 Jul 2024

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Research Library26 Jul 2024

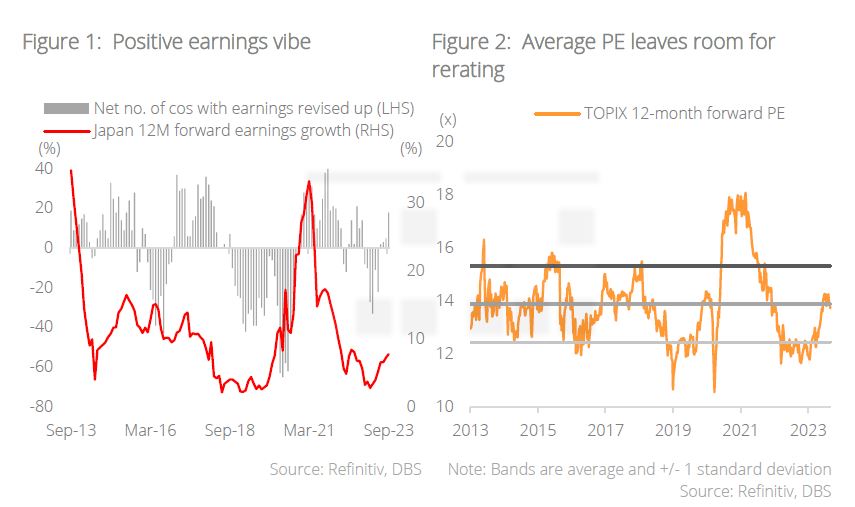

Slowing momentum. Following a robust 20% surge in the TOPIX price during the first half of the year, momentum slowed down in the third quarter, returning a modest 5%. This deceleration was evidently influenced by rising US bond yields, triggered by better-than-expected US economic growth that reduced expectations of Fed rate cuts, and concerns over a US credit rating downgrade, which raised fiscal worries. In a global trend, the BOJ joined other central banks by raising interest rates, eliminating the cap on 10Y JGBs from 0.5% to 1%.

Room for rerating. The TOPIX index also took a pause to assess the health of Japan’s corporate sector during the earnings season. The results for the first quarter of fiscal year 2023 exceeded expectations, leading to an upgrade in earnings forecasts for 20% of Japanese corporations. The average 12-month earnings growth rate rose from 3.7% at the beginning of the year to the current 7.8%. With accelerating nominal GDP growth, supportive policies, a weak Japanese yen, and corporate reforms in play, earnings are expected to provide fundamental support to equities. These factors are anticipated to sustain the market rally, albeit at a moderate pace. Additionally, PE valuations, currently trading at the 10Y average of 14x, leave room for further rerating, supporting a positive outlook for Japanese equities.

Positioning for reflation

The Japanese GDP experienced growth acceleration in the first half of 2023, with nominal GDP expanding by 5.4% y/y in the second quarter. However, this growth was driven primarily by a surge in inflation to 3.3% and real GDP growth of 2%. While these figures surpass historical averages, their sustainability and implications for long-term growth remain uncertain.

Kishida’s new cabinet government will introduce an economic stimulus package that includes measures to counter issues such as inflation and depopulation, so that Japan’s economy can “enter a new phase”.

BOJ Governor Kazuo Ueda has dismissed the possibility of an imminent exit from ultra-loose monetary policy, arguing that inflation driven by robust domestic demand and higher wage growth is necessary for sustainable reflation. We believe reflation trades need to be supported by earnings for them to be sustainable. These would include exports stocks with leading global market share, consumer discretionary in retail and F&B, semiconductors, and banks.

Government support for “economically important sectors” to sustain growth

Amid the ongoing global trade downturn, Japan’s export performance surpasses that of its neighbouring countries. This resilience can be attributed to its diverse export portfolio encompassing electronics, automotive, machinery, high-precision equipment, and the emerging Tourism sector (classified as service exports). These sectors complement each other, mitigating weaknesses and strengths through cycles. For instance, the Electronics sector faced challenges due to reduced demand and inventory destocking post-Covid. In contrast, the Automotive sector, comprising 17% of Japan’s exports, is recovering thanks to supply chain stabilisation and the easing of chip shortages. These economic heavyweights have fostered the global market leaders that have proven their mettle over time.

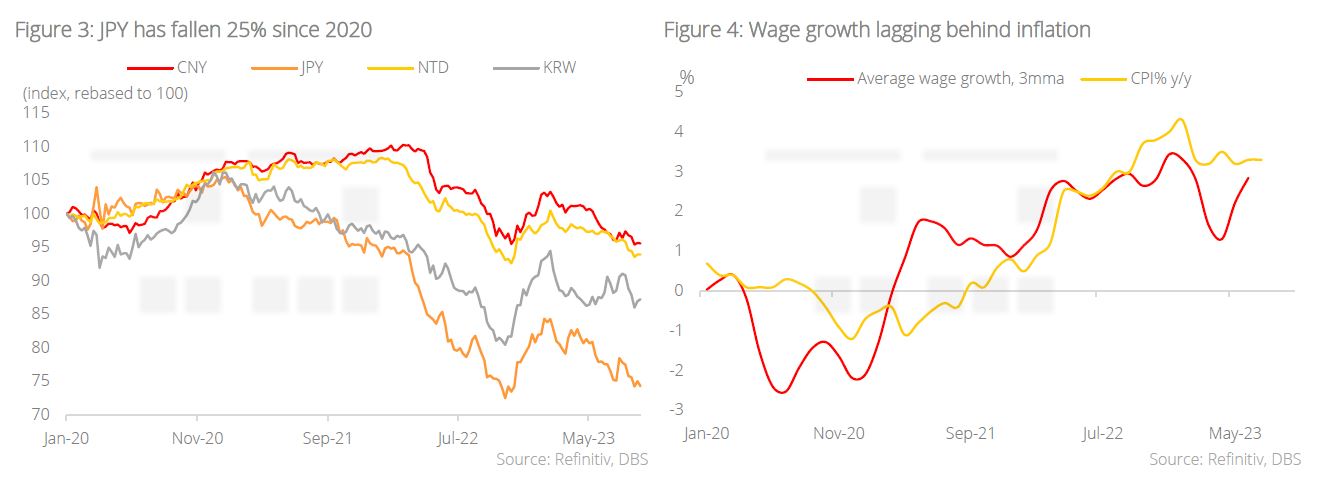

Weak yen, strong boost. Government support measures are expected to highlight the economic significance of these sectors. One example is the substantial depreciation of the yen, with the JPY witnessing a cumulative 25% decline since the beginning of the pandemic in early 2020. The undervalued yen enhances the competitiveness of Japan’s exports and encourages the reshoring of production as more Japanese MNCs rebuild their supply chains in the post-pandemic landscape. The weakened yen has also contributed to the revival of the Tourism sector.

Net-zero targets a key driver. Another illustration of the government’s engagement with sector leaders to achieve national strategic goals is its plan to invest in the semiconductor sector to produce cutting-edge technology chips. The government is already collaborating with the Automotive sector and industrial conglomerates to develop energy solutions to reach its net-zero target.

Booming tourism. Notably, Japan’s tourism exports have outperformed those of its regional counterparts since the post-Covid reopening. While China was the dominant source of tourism before Covid, Japan has successfully diversified its tourist sources in the postpandemic era. The number of foreigners entering Japan reached 80% of pre-pandemic levels, before China’s full reopening. Chinese tourists constituted 30% of Japan’s total visitor arrivals in 2019, a figure that has dwindled to just 5% in the first half of 2023. The rest of Asia now accounts for a significant 70% of Japan’s visitor arrivals. The combination of a weaker yen and Japan’s attractive tourism resources has bolstered this remarkable recovery.

To capitalise on these trends, we recommend investing in globally leading companies in these strategically important sectors.

Consumption hindered by reduced purchasing power

Wage growth a hindrance. On the home front, the significant rise in inflation, primarily attributed to the depreciation of the yen and increased import expenses, may hinder the eagerly awaited rebound in domestic consumer spending. While there has been some improvement in wage growth following the Shunto negotiations, it has still not been sufficient to counteract the inflationary pressures.

Consequently, the reduction in real wages has constrained consumers’ purchasing power and subdued overall consumption. We believe that the government needs to take additional steps to enhance household wealth. Interestingly, the government has been promoting investment in the stock market as a means for individuals to accumulate wealth. An extremely low interest rate environment, rising asset prices, improved labour market conditions, and recovering consumer confidence level collectively strengthened the outlook for discretionary spending, especially in areas such as specialty retail and F&B establishments.

Japan Semiconductor sector

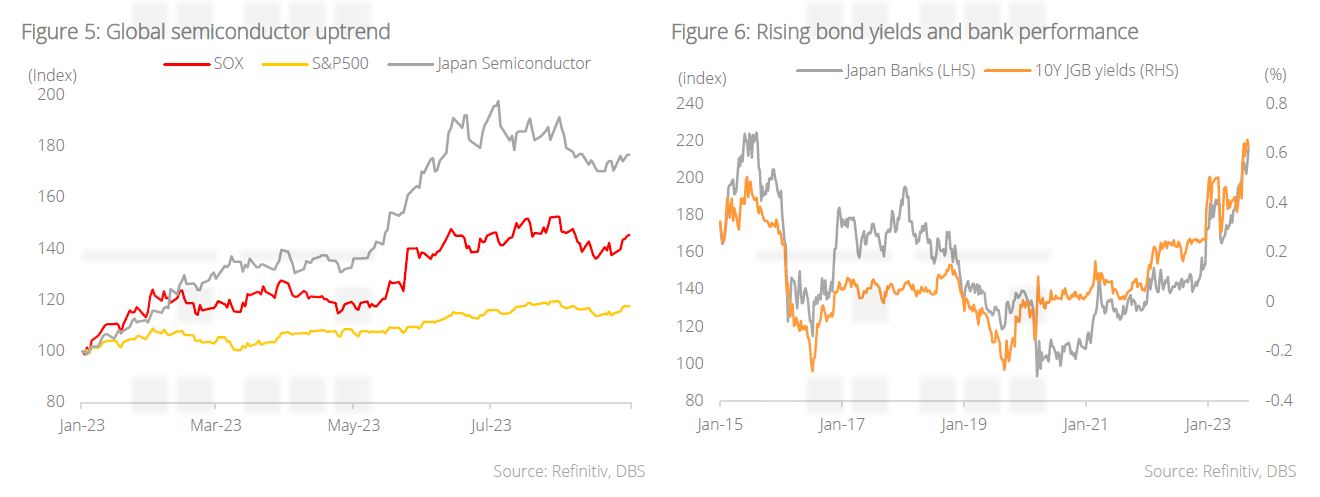

The Philadelphia Stock Exchange Semiconductor Index has shown remarkable performance this year, surpassing the S&P 500 Index and other major benchmarks by a significant margin. Japan’s semiconductor index has also shown impressive outperformance.

With strong government backing, we anticipate that Japan’s semiconductor industry will continue to reap the benefits of global trends in digitalisation and deglobalisation. Prime Minister Fumio Kishida’s administration has committed billions of dollars in subsidies to boost domestic chip production, positioning the country to take advantage of the escalating tech rivalry between the US and China while regaining its leadership in semiconductor manufacturing. The pivotal role of Japan in chipmaking equipment and materials is key to Japan becoming a global leader. It has set its sights on establishing a cutting-edge chip foundry by 2027 and challenging the leading TSMC in mass-producing two-nanometer chips within four years.

The public listing of Arm in the US, a privately held firm under the ownership of SoftBank, is poised to generate heightened excitement within Japan’s semiconductor landscape. Arm is renowned for its expertise in chip design and technology licensing, evident in the instrumental role it plays in the production of over 1b smartphones each year.

Japan banks

Japanese banks’ stock prices are responding favourably to the gradual relaxation of the central bank’s cap on bond yields. This adjustment has occurred twice, first in December 2022 and recently in July 2023, allowing yields to rise to a maximum of 1%.

The banking sector’s earnings have also shown resilience as the economy experiences a reflationary period, with banks being the primary beneficiaries in such an economic environment. In addition to the profitability improvements stemming from shifts in their business portfolios or loan mix, growth in fee-based services, and reductions in operating expenses, banks can anticipate higher loan growth and wider interest margins. Transitioning away from NIRP is expected to boost bank valuations, as it marks a departure from multi-year deeply discounted valuations experienced under NIRP, coinciding with an improved profit outlook.

However, there are lingering concerns regarding the valuation of banks’ investment securities in JGBs if the central bank decides to completely abandon its control over the yield curve. It is crucial to underscore that banks hold JGBs on their balance sheets, and any decreases in their accounting values will primarily impact a bank’s capital ratios rather than leading to immediate earnings losses.

In general, Japan banks maintain strong capital adequacy ratios, which can absorb such losses, especially if the increase in yields occurs gradually. Furthermore, the bank’s capital is bolstered by a diversified and substantial base of retail deposits. Simultaneously, an improvement in their baseline earnings, driven by higher interest margins, can offset the decline in their capital bases over the long term. Therefore, higher interest rates should still exert an overall positive impact on the banks.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Equinix Inc 26 Jul 2024

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Research Library26 Jul 2024

Related insights

- Equinix Inc 26 Jul 2024

- Strong 2Q GDP Highlights Economic Resilience26 Jul 2024

- Research Library26 Jul 2024