- Global OFS market is expected to grow at 3-4% CAGR through 2030; some slowdown is expected in the near term for NAM

- NAM activities should recover in 2025 while international market is expected to retain positive growth momentum; deepwater segment continues to witness robust FID project pipeline

- US election results matter for US O&G market, but oil market fundamentals and energy security concerns will likely carry more weight

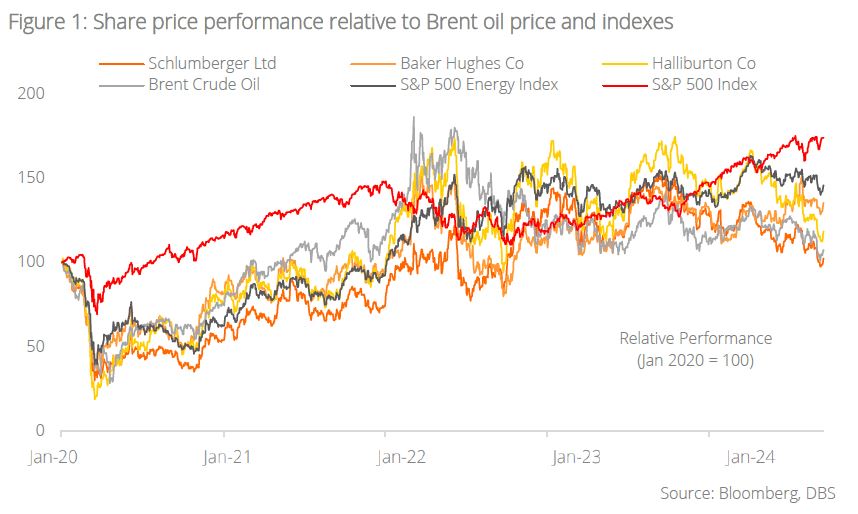

- Most OFS players have corrected c.30% from recent high in April with top three OFS giants now trading at attractive valuations

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

Buoyant international market for oilfield services. The global Oilfield Services (OFS) market is expected to grow at 3-4% CAGR through 2030, driven by robust production and exploration activities (largely due to the rapid growth in the gas segment and deployment of new technologies aimed at optimising production costs). The North American market (NAM) is expected to remain the largest during the forecast period, owing to resilient drilling and production activity in shale fields. However, in the near term, NAM drilling and completion (D&C) capex growth could see single digit decline with pricing pressure in 2024 before turning positive again in 2025. On the other hand, the international D&C market is expected to remain in positive growth territory over the next two years. The deepwater segment remains the star performer, seeing a robust Final Investment Decision (FID) project pipeline.

Will US election results impact the US drillers? While policy actions certainly matter for the oil and gas (O&G) industry’s future, the ever-booming US production levels over the past decade indicate that irrespective of the candidates’ stated stance towards clean energy vs fossil fuels, oil market fundamentals (global oil demand, oil prices, production efficiencies as well as energy security) eventually remain the key drivers. Unlike coal, which has shown clear declining trends in the US, O&G production climbed higher at the end of the administration’s term than at the beginning for the past three US presidencies. Nevertheless, the US election on 5 Nov will be keenly watched as the latest polls show a tight race between Democrats (Kamala Harris) and Republicans (Donald Trump). A Trump win could be mildly positive for the OFS industry, given his widely known stance as a pro-fossil fuel supporter and could potentially stimulate O&G demand further in the US while pressing ahead with LNG export terminal approvals that have been banned by the Biden administration.

Opportunity to bottom-fish blue-chip names. Weak macroeconomics and muted oil market fundamentals – slower-than-expected oil demand and fears of rising OPEC+ supply – have taken a toll on share price performance of OFS stocks the past few months with sharp share price correction of c.30% for most stocks from recent highs in April, pushing valuation of the top three OFS players to an average of 6.5x FY25 EV/EBITDA or 1.7SD below mean. We believe any downside has been priced in to a large extent. The sell-off appears overblown, in our view, given the healthy growth of projected O&G capex in international markets, and oil prices are unlikely to fall below USD70/bbl, as OPEC+ could take more steps to stabilise the oil markets.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024