- Fed Chair Powell signalled imminence of September rate cut at Jackson Hole amid moderating inflation risks and rising downside risks to employment

- Fed policy rates poised to head south; based on Fed Funds futures, five to six rate cuts expected by Jan 2025

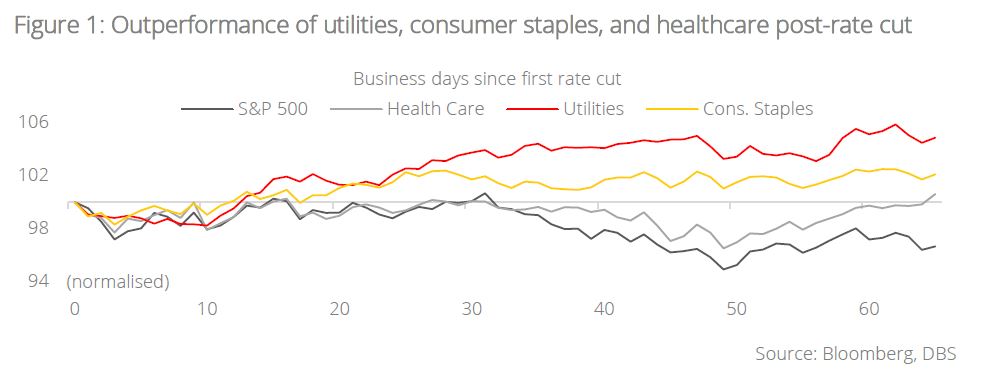

- Historical data shows that utilities, consumer staples, and healthcare tend to outperform three months after the first cut given their defensive qualities as macro momentum moderates

- Utilities possesses consistent revenue streams due to its provisions of basic necessities; offers attractive dividend yield of 3.0% (vs 1.4% for S&P 500), which is attractive for income-seeking investors

- Demand for consumer staples is essentially inelastic; lower interest rate environment reduces interest expense of consumers, enhancing their spending power

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

Dovish speech at Jackson Hole signals imminence of Fed monetary easing cycle. At the Jackson Hole conference, Fed Chair Powell announced that the time has come to adjust monetary policy amid sharp moderation in US headline inflation, which fell from a peak of 9.1% y/y in June 2022 to 2.9% in August. The Fed’s preferred inflation gauge, the PCE price index, has also touched 2.6% y/y in June. With inflation now on a clear path towards the central bank’s 2% target, Powell expressed confidence in the inflation outlook while highlighting increasing downside risk to employment.

Against this backdrop, a Fed rate cut in September is all but locked in. Based on Fed Funds futures, traders are currently pricing-in a 100% probability of one cut in September, and 31.9% chance of a second cut. A total of five to six cuts are expected by Jan 2025.

Learning from history: Beneficiaries of Fed rate cuts in past cycles. Analysing data from the most recent four rate cutting cycles unveils that utilities, consumer staples, and healthcare have, on average, outperformed the S&P 500 by 9.0 %pts, 4.3 %pts, and 4.2 %pts respectively on a three-month basis after the initial cut. We delve into each of these sectors to explore the underlying factors driving their outperformance:

1. Utilities: The utilities sector possesses consistent revenue streams due to its provisions of basic necessities such as electricity, water, and gas. Additionally, utilities currently offer a dividend yield of 3.0% (vs S&P 500's 1.4%) and this is attractive for income-seeking investors, particularly in an environment of falling bond yields. As interest rates decline, yield-focused portfolios will progressively shift allocation from bonds to income equities and this phenomenon augers well for the trajectory of utilities companies.

2. Consumer staples: The demand for consumer staple goods is essentially inelastic as consumers still need to purchase them regardless of the economic situation. Moreover, the lower interest rate environment also reduces the interest expense of consumers, enhancing their spending power. Companies providing “value” goods selling at lower price points will benefit as consumers trade down.

3. Healthcare: Similar to utilities and consumer staples, the demand for healthcare is broadly inelastic regardless of the macro environment and this is particularly so in an aging society. Furthermore, pharmaceutical and biotechnology companies require significant capital for R&D to drive innovation and new product creation. Moderating interest rates reduce the cost of borrowing for R&D expenditures.

Exposure to defensive plays complements our long-term conviction view on technology. Gain exposure to utilities, consumer staples, and healthcare sectors to ride the tailwinds from falling bond yields. From a “barbell” perspective, the resilient and defensive nature of these sectors complements our structural long-term exposure to technology-related plays. Despite overall growth moderation, we expect Big Tech to stay resilient given their diversified revenue streams.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024