- PM Kishida will not be running for another term in the upcoming September LDP elections

- His three-year term saw Japan’s largest wage increases in decades and corporate reforms which continue to deliver improved returns to shareholders

- BOJ gradual rate normalisation expected to stay on track; we maintain our forecast of the policy rate at 0.25% in 2H24 and 0.50% in 1H25

- Government stimulus focus should remain on reducing the strain of inflation on households; support for semiconductor industry to continue

- Continuation of progressive reforms is positive for market sentiment

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

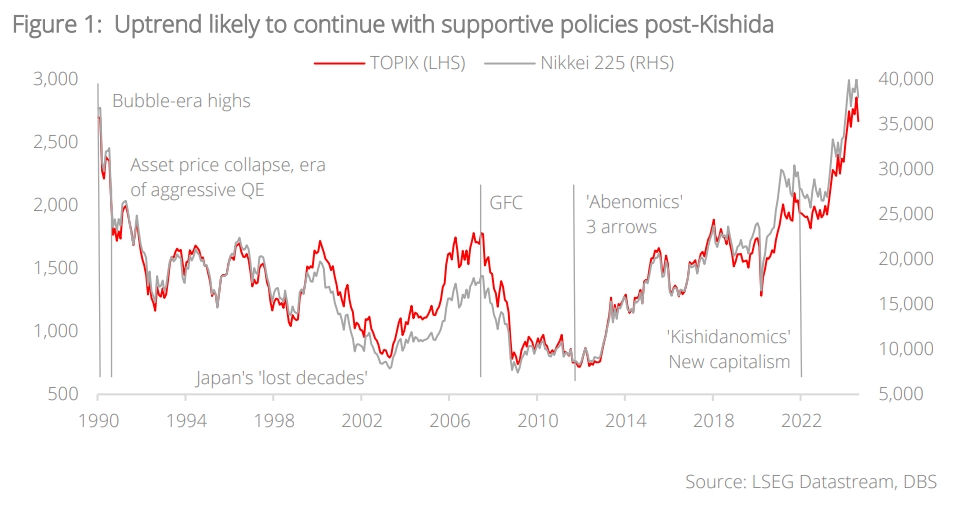

New winds, same sail. Japan’s Prime Minister Fumio Kishida will be stepping down next month, paving the way for a new leader of the ruling Liberal Democratic Party (LDP). Through his three-year term, Kishida had championed the concept of ‘New Capitalism’ which emphasised structural wage growth, the revitalisation of domestic investments, and the transition to a digital society. Under his watch, Japan saw wage increases from labour negotiations hit their highest level in 30 years; he had also pushed for corporate reform to alleviate years of capital inefficiency, improving returns to shareholders at a time where renewed investor interest saw Japan’s stock market indexes surpass historic highs.

The next PM will continue to face challenges from higher costs of living amid slowing global growth and a challenging geopolitical environment. Given the LDP’s dominance in parliament, it is nearly a foregone conclusion that the winner of its September leadership elections will take over from the outgoing Kishida. We do not expect deep policy differences that will significantly impact Japanese corporates and Japan equities.

Stimulus to support growth. From a government stimulus standpoint, key priorities should remain. Unveiled late last year, Kishida’s c.JPY21tn stimulus package focuses on cushioning the impact of inflation on households through measures such as temporary tax cuts and cash handouts. Highlights from the FY24 budget include measures to continue driving wage increments and the enhancement of national defense spending. The government also plans to allocate c.JPY2tn (USD13.7bn) to strengthen the domestic production of semiconductors, a significant increase from the JPY1.3tn (c.USD8.9bn) allocated previously.

BOJ policy deviation unlikely. However, Kishida’s departure has come at a crucial moment for Japan as it emerges from decades of deflation and where a recently resurgent yen abruptly upended a months-long rally of its stock market. Aligned with Kishida’s stance, most leadership candidates have indicated support for the central bank’s gradual policy normalisation. Bank of Japan (BOJ) Deputy Governor Shinichi Uchida noted earlier this month that the central bank is unlikely to raise rates during periods of heightened market volatility. Our economists maintain the view that BOJ is likely to keep the policy rate unchanged at 0.25% in 2H24 then raise it to 0.50% in 1H25, reaching a terminal level of 1.00% by Mar 2026.

While uncertainty could rise in the near term, continuation of progressive reforms should be positive for market sentiment. We continue to emphasise Japan’s semiconductor and IT services sectors as beneficiaries of rapid AI adoption, as well as financials as beneficiaries of interest rate normalisation.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024

Related insights

- Alternatives 1Q25: Gold – Resilience with Alternatives20 Dec 2024

- CIO Insights 1Q25: Game Changers20 Dec 2024

- Bank of America19 Dec 2024