- Rising consumer spending during the summer vacation will fuel stronger demand for payment services

- Revenue of leading players, driven by cross border transactions and VAS, will outgrow the industry average

- Partnerships with B2B platforms will bring new TAM and further boost revenue prospects

- We prefer names with a global presence, diversified revenue mix, and resilience against economic downcycles

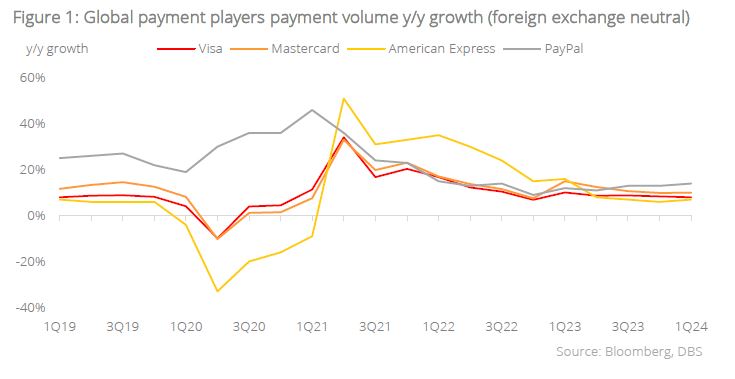

Summer spending to fuel consumer payments. Payment volumes in the US are poised for growth in 2H24, fuelled by an increase in summer spending. According to a recent market survey, US consumers will increase their summer spending across numerous categories, especially on vacations and travel. Millennials and Gen Z are expected to lead this summer’s getaway spending spree, with some 30% stating that they plan to spend more over the next few months compared to a similar period a year ago. This trend will include higher cross-border transactions, driven by longer trips and higher budgets compared to previous years. We expect industry leaders, which will deliver double-digit revenue growth, to outperform their peers in 2024, as they continue to benefit from the expansion in global partnership and scaling up of value-added services (VAS).

Commercialising the untapped B2B payments market. The B2B segment, regarded as a new revenue driver, reflected an encouraging growth trajectory in 1Q24. This was achieved via the issuance of commercial cards, and an expansion of partnerships between B2B platforms and intermediaries in areas such as the travel space. Against this backdrop, the B2B segment is fast emerging as a new growth lever, where the total addressable market is 10X greater than consumer payments. Its larger and more complex transactions, in contrast with that of merchant payments, offer a significant revenue potential and longer growth runway. As current B2B payments are highly manual and fraught with antiquated processes, leading payment providers are likely to gain market share. This is achieved by integrating accounting systems and standardising user data to deliver cost savings such as straight-through processing for payables/receivables, daily accounting entries, cash-flow projection, and reconciliation between suppliers and customers.

We prefer names with a higher cross-border mix, leading positions in the B2B payment market, and lower sensitivity to economic downcycle. We expect the payment industry to maintain a robust growth momentum, driven by 1) secular growth in payment services on rising volumes, especially in cross-border transactions and B2B payments; 2) expansion in partnerships and penetration into new payment categories; and 3) scaling up of VAS revenue. We therefore prefer payment providers that have 1) a global presence which enables them to ride on digitalisation and e-commerce trends; 2) a higher revenue mix towards cross-border payments; 3) rising contribution from VAS revenue; and 4) lower sensitivity to economic downcycle and rising credit costs.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.