- US: Downgrade in growth outlook amid cooler labour market and contracting retail sales; ISM Services Index marks lowest reading since May 2020

- Hong Kong: Economy to stay resilient in the medium term amid regional electronic exports recovery and strong housing demand

- Singapore: Manufacturing output rebounds from March’s plunge; expect reduced business cost pass-through to consumer prices as inflation eases

- Vietnam: 2Q24 growth rose to 6.9% y/y, the fastest since 3Q22; we stay positive on the cyclical outlook and lift our 2024 growth forecast to 6.5% from 6.0%

Related insights

- Research Library17 Jul 2024

- Equities Weekly: Europe Equities – Market Resilience Despite Political Gridlock17 Jul 2024

- Moderna Inc 17 Jul 2024

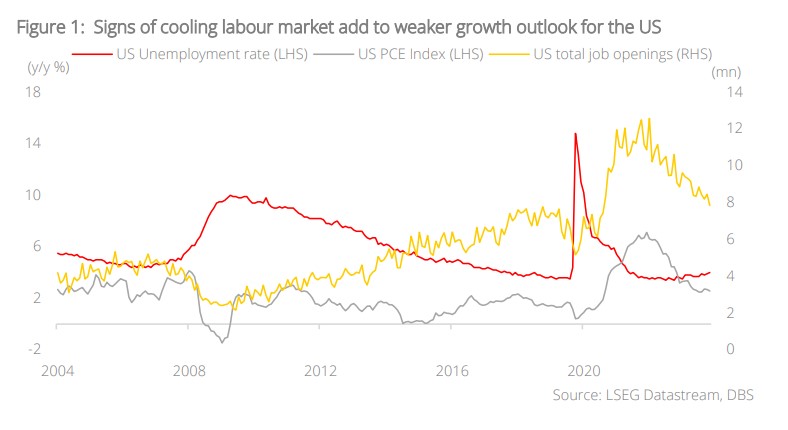

US: Weaker growth outlook as political concerns intensify. The US economy has witnessed a significant downgrade in its growth outlook. Over the past fortnight, the Atlanta Fed GDPNow model halved its GDP growth forecast for 2Q24 to an annualised 1.5% q/q saar from 3.1%. Growth had already decelerated to 1.4% in 1Q24 from 3.4% in 4Q23. In May, retail sales excluding autos contracted at the same 0.1% pace as April and June, and is likely to disappoint too. The ISM Service PMI fell below 50 for the second time in three months to 48.8 in June, the worst reading since May 2020. New orders plunged to 47.3, its worst reading since Dec 2022. Against this background, the Fed is not contemplating a rate hike, but when to start cutting rates, a message Fed Chair Jerome Powell will likely convey to the US Senate Banking Committee next week on 9 July.

US political leadership worries have taken centre stage, eclipsing the French and UK elections. President Joe Biden faces intense pressure to withdraw from his re-election bid at the US Presidential Elections. The US is looking at four more months of political uncertainties vs the end of the French and British elections this week, further underlining the urgency of the situation.

The Fed’s recent narrative suggested that the labour market has become as important as inflation data in providing the Fed the confidence to lower interest rates. Powell echoed San Francisco Fed President Mary Daly’s warning about the US labour market reaching an inflection point, and flagged May’s unemployment rate increase to 4%, citing it had hit the Fed’s projected level for 4Q24. Fed Chair Jerome Powell said the Fed was ready to respond if US jobs weakened unexpectedly. Hence, a continued rise in unemployment above 4% in June is significant, especially if average weekly earnings growth declines below 4% y/y for the first time in three years. Consensus expects nonfarm payrolls released later today to drop below 200k to 190k.

Looking for more evidence that the labour market is cooling, Powell will likely pay attention to the average hourly earnings, which consensus sees declining to 3.9% y/y in June for the first time since Jun 2021.

Download the PDF to read the full report which includes coverage on Credit, FX, Rates, and Thematics.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Research Library17 Jul 2024

- Equities Weekly: Europe Equities – Market Resilience Despite Political Gridlock17 Jul 2024

- Moderna Inc 17 Jul 2024

Related insights

- Research Library17 Jul 2024

- Equities Weekly: Europe Equities – Market Resilience Despite Political Gridlock17 Jul 2024

- Moderna Inc 17 Jul 2024