- When a drug’s patent expires, generic versions of that drug enter the market at lower prices. This is known as a patent cliff

- Sales loss in the US from patent cliffs will more than double from USD67bn (2018-23) to USD145bn (2024-28)

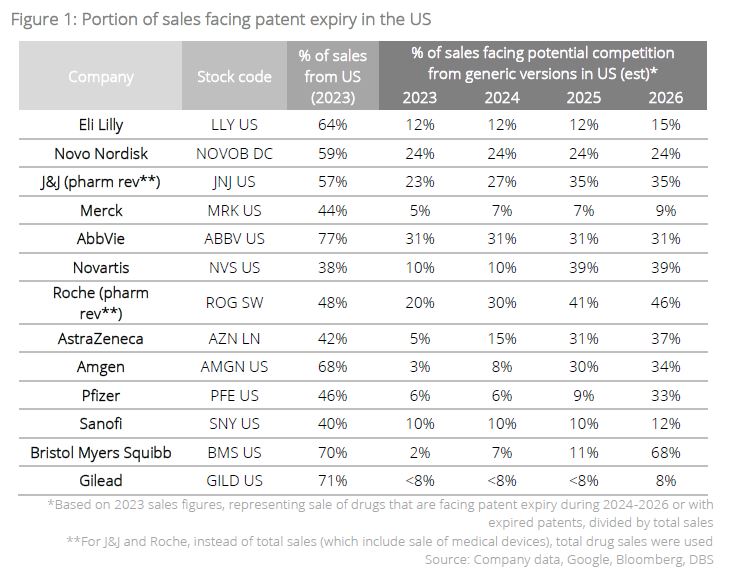

- Eight out of 13 global pharm players making up >50% of the global pharm sector have >30% of their sales facing patent expiry in US by 2026

- Prefer global players with <20% of their sales exposed to patent cliff

Related insights

- Research Library17 Jul 2024

- Equities Weekly: Europe Equities – Market Resilience Despite Political Gridlock17 Jul 2024

- Moderna Inc 17 Jul 2024

Global pharmaceutical players are facing risk of a patent cliff. When a drug’s patent expires, generic versions of that drug enter the market at lower prices, capturing market share from the original drug manufacturer. This is known as a “patent cliff”. Patent expiries can lead to sales of the original drugmaker falling, sometimes by up to four-fold. R&D firm IQVIA expects total sales loss in the US for patented drug makers from a patent expiry will more than double from USD67bn (2018-23) to USD145bn (2024-28).

Players with low sales exposure to patent cliffs can mitigate the risk. For the top 13 industry giants, which make up 55% of global pharmaceutical sector’s market cap, eight of them would have 30% or more of their sales facing patent expiry in US by 2026. This contributes huge uncertainty to their sales. Based on 2026 sales figures, we estimate there are four players with less than 20% of their sales having exposure to the patent cliff. Our preference remains with such players for their potentially higher topline resilience.

New drug approvals and clinical trial data to be upcoming catalysts. Apart from lower exposure to patent cliffs to mitigate risks, investors should also look out for the pipeline for new drug approvals, as well as positive clinical data readout. These factors will help to further mitigate challenges posed by patent cliffs.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.

Related insights

- Research Library17 Jul 2024

- Equities Weekly: Europe Equities – Market Resilience Despite Political Gridlock17 Jul 2024

- Moderna Inc 17 Jul 2024

Related insights

- Research Library17 Jul 2024

- Equities Weekly: Europe Equities – Market Resilience Despite Political Gridlock17 Jul 2024

- Moderna Inc 17 Jul 2024