- US regulatory tightening on Chinese players may lower competition in the US market, which will favour local players

- In Southeast Asia, the competition across e-Commerce platforms has become more rational

- Chinese e-Commerce sector exhibits a slower growth outlook with market-leader (Alibaba) losing market share

- US players delivered encouraging earnings and guided for better profitability prospects

- Other businesses of e-Commerce players, such as cloud and GenAI, are growing in the US, while Southeast Asia counterparts focus on fintech

Related insights

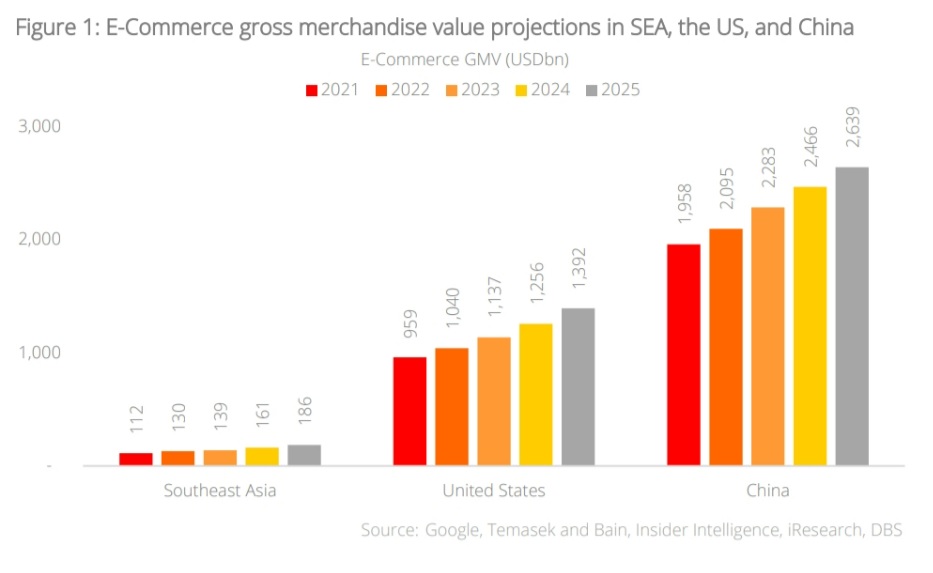

Potential US regulatory tightening on Chinese e-Commerce players to benefit local players; Southeast Asia facing more rational competition. Chinese e-Commerce companies possess 3% market share in the US at end-2023 (vs 21% in Southeast Asia). However, they are now facing regulatory risks from the government, such as inspections on forced labour, data privacy violations, and unfair competitive practices, as well as the removal of US’s de-minimis rule. The regulatory tightening moves, should they be approved, are expected to reduce competition in the US e-Commerce sector.

Currently, over 70% of customers subscribe to a loyalty membership with Amazon (the US market leader), which offers free same-day delivery to its members. US customers value product quality, variety, and faster delivery times, compared to Southeast Asian (SEA) customers, who tend to be more price sensitive. Post-consolidation of e-Commerce firms in Indonesia, SEA is now seeing a more rational competitive scene. Instead of focusing on cutting prices and growth at any cost, SEA players are steering toward profitability improvements by raising commission rates along with reductions in promotions and logistics subsidies.

US players beat estimates in 1Q24 while SEA companies players focus on profitability. In 1Q24, US players beat market estimates, with other business segments witnessing all-time-high margins. US players’ guidance for 2Q24F are in line with market projections, while their guidance for international businesses turned profitable. On the other hand, while Chinese e-Commerce corporate earnings met market expectations, their investments in international markets may result in the dilution of overall profitability. In SEA, e-Commerce companies are focusing on being EBITDA positive.

Other businesses of e-commerce players are showing potential. US e-Commerce players stand to benefit from renewed growth in cloud services after a brief slowdown in 2023. Some of the drivers include the impact of generative artificial intelligence (GenAI) on ad placements, user engagements, and conversions. While Chinese e-Commerce firms also offer cloud services, it will take them more time to achieve meaningful growth given macroeconomic headwinds in this region. Rather, they are placing larger emphasis on growing their fintech businesses, in the lending segment particularly, so as to monetise their large e-commerce user base in SEA.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.