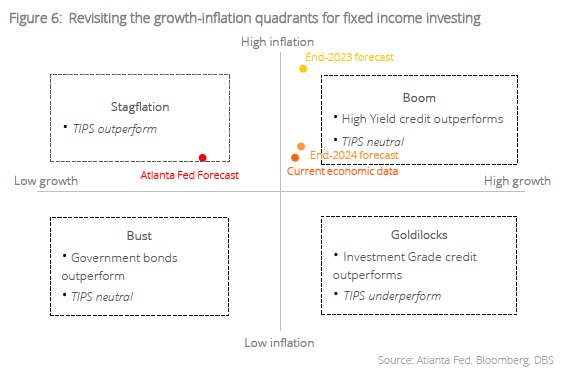

- President Trump’s tariff-driven uncertainties have reduced growth expectations but raised inflationary pressure – a recipe for stagflation

- There is a niche bond instrument that precisely thrives in such an outcome – Treasury Inflation‑Protected Securities (TIPS)

- TIPS real yields have likely plateaued given that the Fed has begun to cut rates. Slower growth projections imply that the Fed may need to lower rates further – which is a tailwind for TIPS

- Moreover, TIPS have an index ratio that adjusts both principal and coupon upwards in line with higher CPI, preserving the real value of investors’ capital and coupon payments

- We think that long-duration TIPS are attractive given the steep real yield curve

New world disorder. The days of late cannot go by without some form of geopolitical or economic shock occupying the headlines. It is a rude awakening for the capital markets, which had initially cheered the perpetuation of American exceptionalism under President Trump’s second act in office. His barrage of tariffs and taunting of traditional US allies, however, have brought sentiment down to the doldrums – as growth is expected to be tepid in a world of uncertainty, while inflation remains sticky as tariff pains begin to bite.

Feeling TIPSy. That is not to say, however, that investors must sit idly by and watch their portfolios get decimated by volatility. In a niche corner of the bond markets lies an instrument that precisely caters for such uncertainty – one that does especially well in an environment of stagnant growth and higher inflation – and that is Treasury Inflation‑Protected Securities (TIPS). A brief explanation of its mechanism is helpful before we dive into the strategy proper.

How do TIPS work?

TIPS are government-backed securities issued with maturities of 5, 10, and 30 years, with coupons paid semi-annually. The security functions like a bond in essence, except for the use of an index ratio to adjust the principal and coupon payment to match the rate of inflation.

By way of illustration, suppose an investor owns USD1,000 in TIPS with a coupon rate of 1%. If there was no inflation as measured by the CPI, then the principal of the bond remains at USD1,000 and the coupon received for the year would be USD10 (1% x USD1,000). However, if inflation rises by 2% at the end of the year, then the principal is adjusted by the index ratio of 1.02 to become USD1,020, while the coupon payment concurrently rises to USD10.20 (1% x USD1,020). Note that this works both ways; the principal and coupon can also be adjusted downward under deflationary scenarios, but the investor is accorded a certain degree of downside protection as they redeem the higher of the adjusted principal or the original principal at maturity.

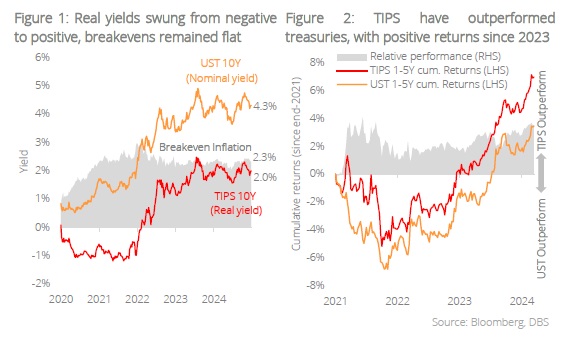

TIPS did not protect against the inflation spike of 2022. This would not be the first time that we have opined on this instrument. In anticipation of higher inflation, investors were quite keen to explore TIPS at the end of 2021 in what was seemingly a good idea to hedge against a sudden spike in prices. Back then, however, our stance was not one of embrace, but rather caution, seeing that TIPS (real) yields were negative – meaning that prices were already bid up so high that investors were assured negative returns from the pull to par effect (without the inflation adjustment of the index ratio). Notwithstanding, TIPS did outperform US treasuries in that same inflationary period, but that outperformance was not good enough to prevent it from clocking negative total returns in 2022 like the rest of the fixed income markets. Investors that favoured TIPS over treasuries had the consolation of a participant who came in second last in a beauty contest – their investment mitigated some losses but was far from living up to its namesake as an inflation protector.

Real yields at a tipping point. The biggest headwind at the time was clearly the Fed’s aggressive rate hiking cycle, pushing real yields up to a 16-year high within a short span of 1.5 years. The difference for TIPS today, we believe, is that real yields have plateaued as the Fed has already begun a rate cutting cycle. Unless the Fed makes a complete u-turn and hikes rates again – which amounts to a calamitous blunder in forward guidance – the biggest headwind for TIPS is largely behind us. Moreover, a slowdown in growth, as several economic indicators seem to be flashing, implies that the Fed may need to bring down the levels of real rates in due time to provide further accommodation to the economy. Such turning points are often the greatest opportunities for nimble investors to capitalise on.

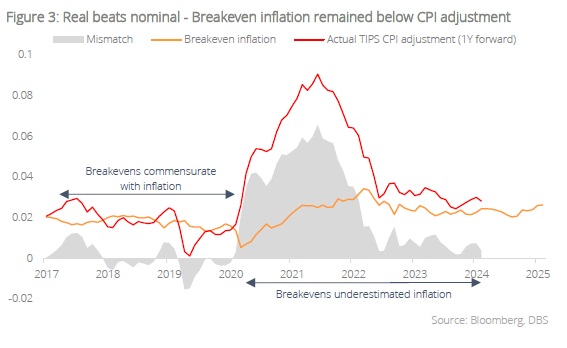

Breakevens have underestimated actual inflation. Why did TIPS outperform nominal treasuries? We compared 5Y breakeven inflation rates against the actual TIPS CPI adjustment 1Y forward and found that breakevens had persistently underestimated the strength and persistence of actual inflation – for more than five years in a row now (Figure 3). Breakeven inflation hardly moved beyond its tight range of 2-3% despite headline CPI soaring to 9% and beyond (recall that nominal yield = real yield + breakeven inflation). Given that the ongoing threat of tit-for-tat tariffs presents upside risks to CPI prints, one could say that 5Y US breakeven inflation rates at around just 2.5% today appear complacent; surely a security with inflation-hedging characteristics can provide the optionality that would be valuable in uncertainty.

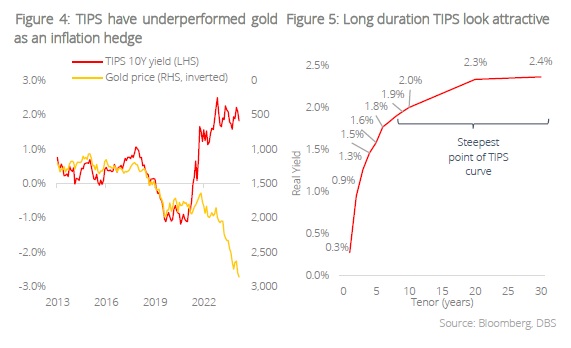

Other potential considerations. As an inflation hedge, TIPS yields and gold have had near perfect correlations before 2022 (Figure 4). Something drastic had occurred in that year which forced a decoupling of these inflation hedges, – you guessed it – war. As the US unilaterally froze USD300bn in Russian foreign holdings at the start of Moscow's invasion of Ukraine, countries were forced to make distinctions between TIPS and gold – the former is a debt instrument, while the latter was a neutral reserve asset. While we remain positive on gold, our take is that this decoupling cannot diverge forever; eventually the real yields on TIPS become enticing enough versus the yellow metal that pays no interest.

Ultra-long duration TIPS look attractive. For all our caution on duration, TIPS is one instrument that we have a favorable long duration view, given that the TIPS curve is very steep (Figure 5) – investors are adequately compensated for going long. Given the level of indebtedness in the US, it makes little sense for debt sustainability if real yields remained positive for the very long term. Also, this is one debt instrument that the US cannot “inflate away”, given that the principal adjusts with inflation. The Trump administration appears to be serious about the issues of debt sustainability (for now), which is a small plus given that TIPS are ultimately backed by the creditworthiness of the US government.

The bond that beats stagflation. Finally, as a reminder, TIPS sit uniquely in the upper left space of the growth-inflation quadrants for fixed income investing as the only security that performs well in stagflation (Figure 6). Yet TIPS, we believe, does not need stagflation to perform well. Just like the most of the fixed income markets, yields today are high enough for decent recurring income – for TIPS, however, more than a hedge for slower growth, mechanisms ensure that the purchasing power of future coupon payments are commensurate with inflation. What’s not to like?

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.