- Gold hits a series of all-time highs amid global trade war fears; latest high of USD2,882/oz. achieved on 5 Feb

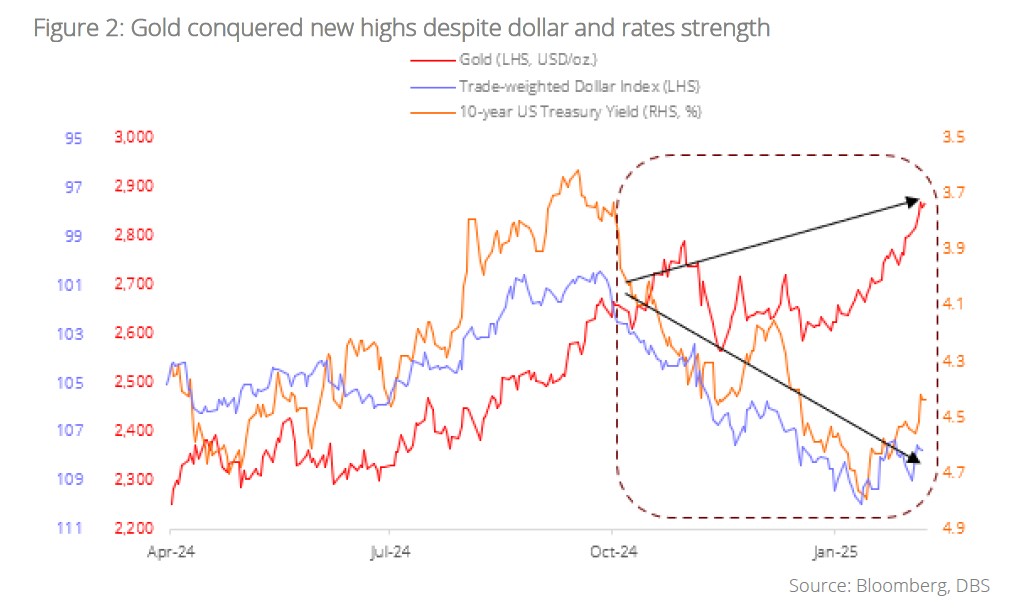

- Elevated global uncertainties in Trump 2.0 era have insulated gold from dollar and rate strength

- Rising US fiscal deficit and global fragmentation add to gold’s long-term appeal

- Outlook for gold remains positive; upgrade 12M TP to USD3,330/oz.

Upgrade 12M TP to USD3,330/oz.. We published a report on 4 Feb covering how tariff fears sparked gold hoarding in New York, and how that consequently propelled bullion to a new all-time high. Since then, gold has continued its upward march on worries of a full-blown trade war, setting a new record of USD2,882/oz. on 5 Feb. This report aims to further build on the commentary from the previous report, as well as provide the basis for our 12-month target price, which we have revised upwards to USD3,330/oz.

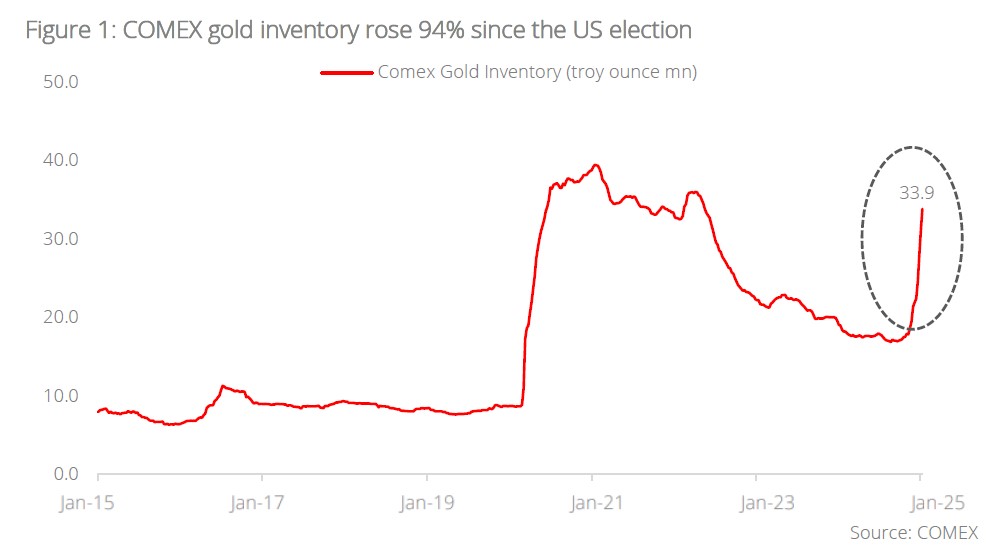

Tariff fears see gold stockpiling in New York. The immediate catalyst for the latest gold rally was fear around trade tariffs, specifically the possibility that bullion, which has historically been exempt from import duties, might be taxed in the future. This has resulted in a stockpiling of gold on COMEX, the New York commodity exchange – since the US election in November last year, inventory levels have risen 94% to reach c.33.9mn troy ounces, or USD97.0bn at current market price. Additionally, the DeepSeek-driven sell-off in the equities space likely contributed to further risk-off fund flows into the asset class. We have called for a gold positive environment since Trump’s victory in our CIO perspectives article titled: Trump 2.0 – Winners & Losers (published 7 Nov 2024), highlighting policy uncertainties as a supporting factor for the asset class, and this call has played out to a tee. Notably, despite considerable dollar and rates strength since October last year, gold has remained remarkably resilient due to elevated uncertainty in the macro environment.

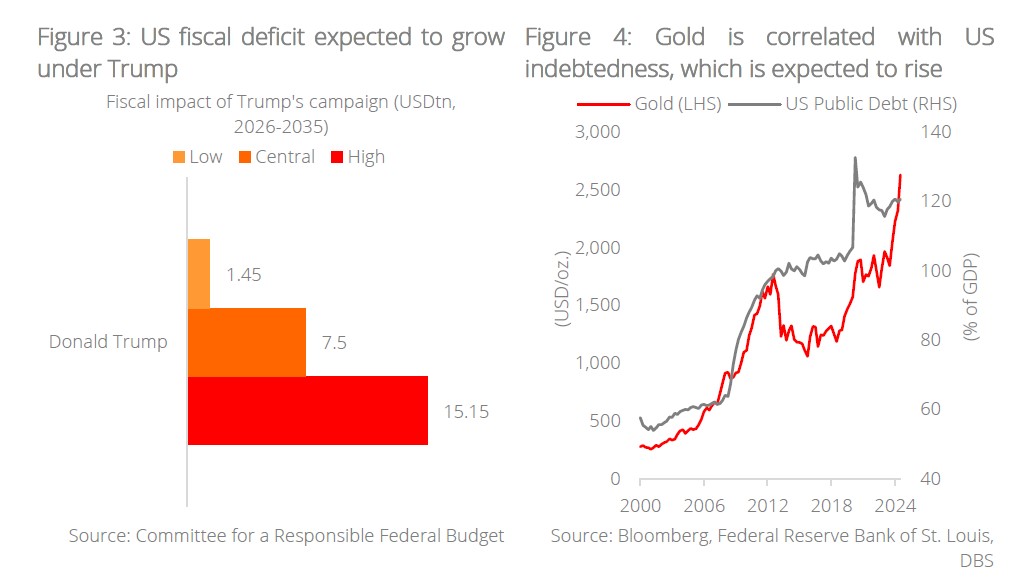

Tailwinds from rising fiscal deficits intact. In addition to the immediate catalysts mentioned above, the long-term tailwinds highlighted in our latest CIO Insights chapter on gold (Alternatives 1Q25: Gold – Resilience with Alternatives) remain intact. Chief among them is the growing US fiscal deficit. Under Trump, expansionary policies such as tax cuts, increased fiscal spending and de-regulation are expected to take place, and this will likely exacerbate the US fiscal deficit and prompt an expansion of liquidity in the future which is positive for gold from a monetary debasement angle.

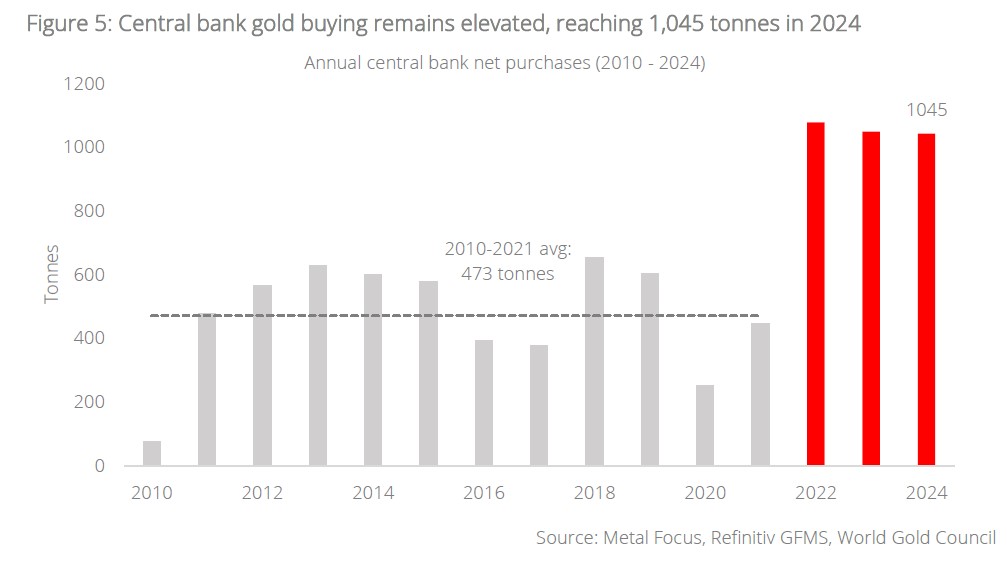

Geopolitics to continue driving de-dollarisation demand. The world is expected to become more fragmented from a geopolitical perspective under Trump 2.0, and that will continue to drive central bank demand for gold, especially among the BRICs+ nations, which view bullion as their biggest alternative to the dollar. This trend propelled central bank gold buying to a whopping 1,045 tonnes in 2024. This is the third consecutive year central bank buying exceeded the thousand-tonne mark – significantly higher than the c.473-tonne average between 2010 – 2021. It is also worth noting that de-dollarisation demand is not exclusive to central banks, more investor classes are beginning to see the merits of buying gold as a hedge against dollar and monetary debasement risk. This is evidenced by robust investment demand for gold, which grew 25% y/y in 2024 to reach 1,180 tonnes, a four-year high. To summarise, fiscal expansion in the US and growing global fragmentation will continue to strengthen the appeal of gold in the long-term.

Structurally bullish on gold. In the short-term, there are uncertainties surrounding gold’s outlook; bouts of dollar and rate strength can potentially weigh down on gold prices. However, as the past three months have shown, the heightened volatility from Trump 2.0 can just as easily buoy safe haven demand for bullion. In the longer term, there will continue to be upward pressure on gold price as the debasement trade chugs on. On balance, the outlook for gold remains positive and we upgrade our 12M target price for gold to USD3,330/oz. based on the assumption of a dollar index level of 110.8 and US 10-year treasury yield of 4.4% by 1Q26. We continue to advocate for clients to hold gold in their portfolios for its upside potential as well as its risk diversification properties due to its low correlation with public bonds and equities.

Topic

The information published by DBS Bank Ltd. (company registration no.: 196800306E) (“DBS”) is for information only. It is based on information or opinions obtained from sources believed to be reliable (but which have not been independently verified by DBS, its related companies and affiliates (“DBS Group”)) and to the maximum extent permitted by law, DBS Group does not make any representation or warranty (express or implied) as to its accuracy, completeness, timeliness or correctness for any particular purpose. Opinions and estimates are subject to change without notice. The publication and distribution of the information does not constitute nor does it imply any form of endorsement by DBS Group of any person, entity, services or products described or appearing in the information. Any past performance, projection, forecast or simulation of results is not necessarily indicative of the future or likely performance of any investment or securities. Foreign exchange transactions involve risks. You should note that fluctuations in foreign exchange rates may result in losses. You may wish to seek your own independent financial, tax, or legal advice or make such independent investigations as you consider necessary or appropriate.

The information published is not and does not constitute or form part of any offer, recommendation, invitation or solicitation to subscribe to or to enter into any transaction; nor is it calculated to invite, nor does it permit the making of offers to the public to subscribe to or enter into any transaction in any jurisdiction or country in which such offer, recommendation, invitation or solicitation is not authorised or to any person to whom it is unlawful to make such offer, recommendation, invitation or solicitation or where such offer, recommendation, invitation or solicitation would be contrary to law or regulation or which would subject DBS Group to any registration requirement within such jurisdiction or country, and should not be viewed as such. Without prejudice to the generality of the foregoing, the information, services or products described or appearing in the information are not specifically intended for or specifically targeted at the public in any specific jurisdiction.

The information is the property of DBS and is protected by applicable intellectual property laws. No reproduction, transmission, sale, distribution, publication, broadcast, circulation, modification, dissemination, or commercial exploitation such information in any manner (including electronic, print or other media now known or hereafter developed) is permitted.

DBS Group and its respective directors, officers and/or employees may have positions or other interests in, and may effect transactions in securities mentioned and may also perform or seek to perform broking, investment banking and other banking or financial services to any persons or entities mentioned.

To the maximum extent permitted by law, DBS Group accepts no liability for any losses or damages (including direct, special, indirect, consequential, incidental or loss of profits) of any kind arising from or in connection with any reliance and/or use of the information (including any error, omission or misstatement, negligent or otherwise) or further communication, even if DBS Group has been advised of the possibility thereof.

The information is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. The information is distributed (a) in Singapore, by DBS Bank Ltd.; (b) in China, by DBS Bank (China) Ltd; (c) in Hong Kong, by DBS Bank (Hong Kong) Limited; (d) in Taiwan, by DBS Bank (Taiwan) Ltd; (e) in Indonesia, by PT DBS Indonesia; and (f) in India, by DBS Bank Ltd, Mumbai Branch.